Is a High-Yield Savings Account Worth It?

Anúncios

Choosing where to store your hard-earned money is a crucial financial decision. While traditional savings accounts are a common choice, high-yield savings accounts (HYSAs) have become a popular alternative due to their significantly higher interest rates. But are they worth it? This guide will explore what HYSAs are, their benefits and drawbacks, and how to decide if one aligns with your financial goals.

What Is a High-Yield Savings Account?

A high-yield savings account is a specialized savings account offering much higher annual percentage yields (APYs) than traditional savings accounts. While standard accounts often offer APYs of 0.01% to 0.05%, HYSAs can provide rates between 3% and 5% depending on market conditions. They are typically offered by online banks, which operate with lower overhead costs, allowing them to pass on the savings to customers.

Key Features of HYSAs

- Higher APYs: These accounts maximize the growth of your savings.

- FDIC Insurance: Like traditional accounts, HYSAs are insured up to $250,000, offering security.

- Online Accessibility: Many HYSAs are managed through online banking platforms or mobile apps, offering convenience.

HYSAs are often used for short-term financial goals like emergency funds or saving for a large purchase while maintaining easy access to funds.

Benefits of a High-Yield Savings Account

1. Higher Interest Rates

The standout benefit of an HYSA is its ability to grow your savings faster. For example:

- A $10,000 balance in a traditional savings account with a 0.01% APY earns $1 annually.

- The same $10,000 in an HYSA with a 4% APY earns $400 in one year.

This significant difference helps savers reach their financial goals more quickly.

2. Low-Risk Savings Option

HYSAs are one of the safest ways to grow money, offering stable returns without exposure to market volatility. With FDIC insurance, your deposits are protected, making them an ideal choice for risk-averse savers.

3. Liquidity and Flexibility

Unlike certificates of deposit (CDs), HYSAs don’t lock your funds for a fixed term. You can access your money quickly in case of emergencies, making them ideal for:

- Emergency funds

- Vacation savings

- Upcoming purchases

4. No Long-Term Commitments

HYSAs allow you to deposit or withdraw money as needed, free of penalties or time constraints. This flexibility is a significant advantage over CDs or other long-term savings tools.

5. Easy Account Management

Most HYSAs are offered through online banks, enabling users to manage accounts conveniently using mobile apps or online platforms. These tools often include features like automatic transfers and spending insights.

Drawbacks of High-Yield Savings Accounts

1. Limited Growth Potential

While HYSAs outperform traditional savings accounts, their earning potential falls short compared to investments like stocks or ETFs. Over the long term, investment accounts typically provide higher returns, making HYSAs less suitable for wealth-building.

2. Variable Interest Rates

HYSAs often have interest rates that fluctuate based on the Federal Reserve’s policies. A 4% APY today could drop to 3% or lower if market conditions change, affecting your overall earnings.

3. Online-Only Limitations

Since many HYSAs are offered by online banks, challenges include:

- Limited physical branches

- Difficulty depositing cash

- Potentially slower customer service for complex issues

4. Potential Fees

Although many HYSAs are fee-free, some accounts charge for:

- Monthly maintenance

- Excessive withdrawals (beyond six per month)

- Failing to meet minimum balance requirements

Fees can quickly eat into your interest earnings, so it’s essential to read the fine print.

Who Should Consider a High-Yield Savings Account?

Ideal Candidates

- Emergency Fund Savers: HYSAs are excellent for storing emergency funds due to their accessibility and higher returns.

- Short-Term Goal Seekers: If you’re saving for a vacation, wedding, or down payment, HYSAs help grow your money faster.

- Risk-Averse Individuals: For those wary of market risks, HYSAs provide a safe haven for savings.

Who Might Look Elsewhere

- Long-Term Investors: If your primary goal is building wealth for retirement, an investment account may offer better returns.

- Cash-Heavy Users: Those who frequently deal with cash deposits may find online-only HYSAs less convenient.

How to Choose the Best High-Yield Savings Account

1. Compare APYs

Not all HYSAs are created equal. Use comparison tools like Bankrate or NerdWallet to find accounts with competitive interest rates.

2. Look for Low or No Fees

Choose accounts that minimize fees, including:

- No minimum balance requirements

- No monthly maintenance charges

- Free transfers to linked accounts

3. Evaluate Accessibility

Consider how easily you can access and manage your funds:

- Mobile App Features: Ensure the app is user-friendly and includes tools for tracking your progress.

- ATM Access: Look for accounts that offer free ATM withdrawals or reimburse fees.

- Speed of Transfers: Check how quickly you can transfer funds between accounts.

4. Confirm FDIC Insurance

Verify that the bank is FDIC-insured to ensure your deposits are protected up to $250,000.

Alternatives to High-Yield Savings Accounts

If an HYSA doesn’t meet your needs, here are other options to consider:

Certificates of Deposit (CDs)

- Higher fixed interest rates than HYSAs

- Requires locking funds for a set period (e.g., 6 months to 5 years)

- Suitable for medium-term goals

Money Market Accounts (MMAs)

- Offers features of both savings and checking accounts

- Higher interest rates than traditional savings accounts

- Limited check-writing and debit card access

Investment Accounts

- Potential for much higher returns over time

- Suitable for long-term goals like retirement

- Involves greater risks compared to HYSAs

Real-Life Example: How Much Can You Earn with a High-Yield Savings Account?

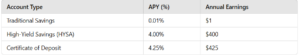

Here’s a comparison of annual earnings on a $10,000 balance across different account types:

This example highlights the significant advantage of HYSAs over traditional accounts while maintaining flexibility.

Tips to Maximize Your High-Yield Savings Account

- Set Up Automatic Transfers: Schedule monthly transfers to ensure consistent savings.

- Avoid Excessive Withdrawals: Stay within the account’s withdrawal limits to avoid fees.

- Monitor APYs Regularly: Keep an eye on interest rates and switch accounts if better options become available.

- Combine Accounts Strategically: Use an HYSA for short-term savings and an investment account for long-term goals.

Conclusion

A high-yield savings account is a powerful tool for growing your savings safely and efficiently. With higher APYs, FDIC insurance, and flexibility, HYSAs are ideal for short-term goals and emergency funds. However, they may not be the best option for long-term investments or individuals needing in-person banking services.

By comparing APYs, minimizing fees, and ensuring accessibility, you can choose an HYSA that aligns with your financial goals. With the right account, your money will work harder for you, helping you achieve financial security and peace of mind.