Credit usage monitoring tool: boost your financial health

Anúncios

A credit usage monitoring tool helps track your credit score and spending habits, enabling you to manage your finances effectively and make informed decisions for improving your credit health.

Credit usage monitoring tool can significantly impact your financial well-being. Imagine having a platform that keeps you updated on your spending habits and credit score. Curious about how this can enhance your financial management? Let’s explore.

Anúncios

Understanding credit usage monitoring tools

Understanding how credit usage monitoring tools work is essential for managing your finances effectively. These tools can help you stay on top of your spending and improve your credit profile. Learning about their features can empower you to make informed financial decisions.

What Are Credit Usage Monitoring Tools?

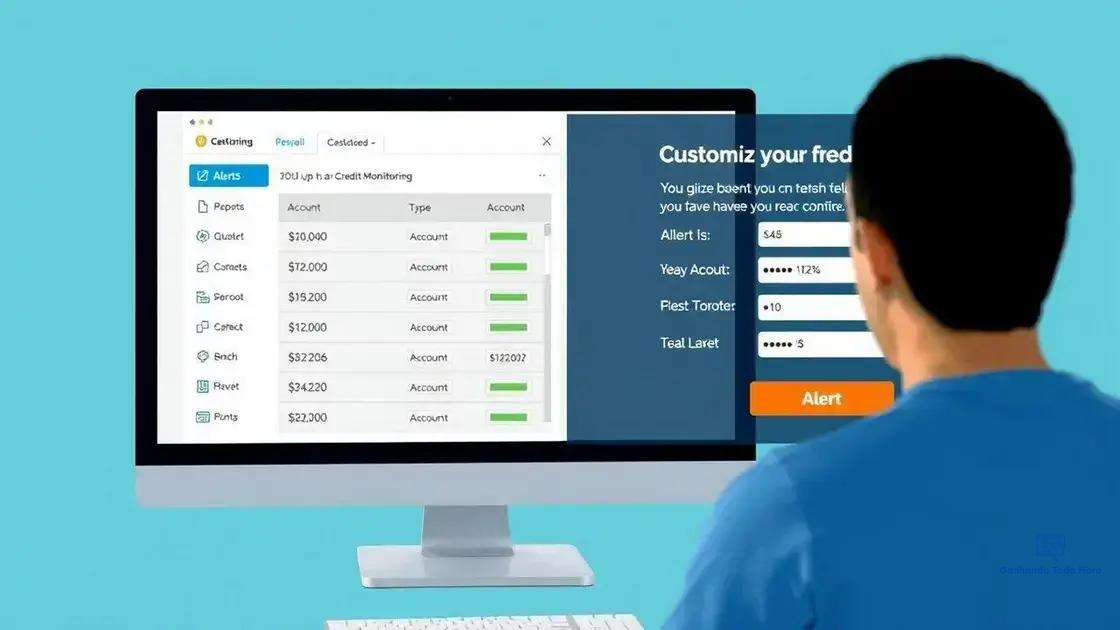

Credit usage monitoring tools are designed to track your credit usage and provide insights into your financial health. They monitor various factors that affect your credit score, such as your credit utilization ratio, payment history, and recent credit inquiries. By understanding these tools, you can take control of your credit account.

Key Features of These Tools

- Real-time alerts: Receive notifications about significant changes to your credit report.

- Spending insights: Get detailed reports on your spending habits and credit usage.

- Credit score tracking: Monitor changes to your credit score over time.

- Identity theft protection: Some tools offer security features to protect against fraud.

These features not only help you understand your credit status but also guide you in taking actionable steps to improve it. For example, if you notice high credit utilization, you can adjust your spending to keep your ratio healthy. Being proactive is crucial.

When seeking a credit usage monitoring tool, consider what features are most important to you. Some tools may emphasize educational resources, while others may focus on real-time data analysis. Choose one that fits your lifestyle and financial goals. Maintaining a good credit score can save you money.

Anúncios

Incorporating these tools into your financial planning can be highly beneficial. The insights provided help you navigate credit-related decisions with confidence. Take time to explore various options available in the market.

Tracking your credit usage is vital. With the right credit usage monitoring tools, you can make informed decisions, improve your financial health, and achieve your credit goals.

Benefits of using a credit usage monitoring tool

The benefits of using a credit usage monitoring tool are significant and can greatly enhance your financial literacy. These tools help you keep track of your credit usage, which ultimately leads to better financial decisions.

Improved Financial Awareness

One of the main advantages is that they increase your financial awareness. By actively tracking your credit utilization, you understand how your spending affects your credit score. When you see your credit data regularly, you become more mindful of your financial habits.

Identifying Issues Early

Another benefit is the ability to identify potential issues before they escalate. If you notice unusual spikes in your credit usage or declines in your score, you can address these concerns quickly. Monitoring allows for proactive management of your finances, which can save you from future problems.

- Prevent Identity Theft: With monitoring tools, you can quickly spot unauthorized activities that may indicate identity theft.

- Better Credit Score Management: Understanding your credit usage helps you maintain or improve your credit score over time.

- Budgeting Insights: Many tools provide insights that can help with budgeting, allowing you to align your spending with your financial goals.

- Informed Credit Decisions: You’ll be more equipped to make informed choices when applying for loans or credit cards.

Being aware of your credit standing can also inspire you to create a personal budget. A credit usage monitoring tool can motivate you to spend wisely and prioritize payments. With these tools, financial education is at your fingertips.

Subscribing to a monitoring service can offer peace of mind. Knowing that someone is tracking your credit can alleviate the stress associated with financial management. You’ll be empowered to make better choices and attain your financial goals successfully.

Utilizing a credit usage monitoring tool is a practical step toward not just understanding your credit score but improving it. Embrace these resources and take charge of your financial future.

How to choose the right tool for your needs

Choosing the right credit usage monitoring tool can feel overwhelming, but it doesn’t have to be. By considering your specific needs, you can find a tool that fits perfectly into your financial management routine. Start by identifying what features are most important to you.

Assess Your Financial Goals

Understanding your financial goals is the first step. Are you looking to rebuild your credit score, or are you more focused on tracking your spending? Once you know your objectives, you can narrow down the tools that offer features tailored to these needs.

Consider Key Features

Different tools have various features. It is essential to find one that aligns with your requirements. Look for tools that provide:

- Credit Score Tracking: Monitor your credit score regularly to stay informed about changes.

- Spending Alerts: Receive notifications when you reach certain spending thresholds.

- Identity Theft Protection: Ensure the tool offers monitoring for signs of fraud.

- User-Friendly Interface: A simple, easy-to-navigate layout can make your experience much more enjoyable.

After narrowing down your options based on features, it’s time to read user reviews. Checking what others have to say can offer insights into the reliability and effectiveness of the tool. Look for feedback about their customer service and user experience, as this can influence your decision.

Additionally, consider whether the tool fits your budget. Many tools offer free versions with limited features, while paid subscriptions may provide more comprehensive options. Evaluate what you’re getting for your money and see if the benefits align with your financial strategies.

Finally, take advantage of free trials when available. Testing a tool before committing is an excellent way to see if it meets your needs. If you find a tool that aligns with your goals and provides a positive user experience, you are in a great position to enhance your financial management.

Setting up your credit monitoring tool effectively

Setting up your credit monitoring tool effectively is crucial for gaining the most benefits from it. A well-configured tool allows you to receive timely alerts and insights, leading to smarter financial decisions. Start by creating an account and entering your personal information accurately.

Linking Your Financial Accounts

Once your account is created, linking your financial accounts is a vital next step. This helps the tool gather data about your transactions and credit activity. Make sure to connect:

- Bank Accounts: Link your primary bank accounts for comprehensive spending analysis.

- Credit Cards: Include all active credit cards to track your usage efficiently.

- Loans: Add any existing loans, including student or auto loans, for a complete picture of your finances.

After linking your accounts, customize your alert settings. Most tools allow you to choose what notifications you want to receive and how often. Opt for real-time alerts for significant changes in your credit. This way, you can act quickly if you spot any suspicious activity.

Understanding Reports and Insights

Next, familiarize yourself with the reports and insights provided by the tool. Most platforms offer a dashboard that gives you an overview of your credit score and major factors affecting it. Regularly review your performance and look for trends. This can help you take action when needed, such as reducing spending or making payments on time.

Utilizing educational resources is also important. Many tools provide articles and tips about managing credit effectively. Leverage these resources to boost your financial literacy and make informed decisions. Being proactive can lead to better credit health over time.

Finally, regularly check your app or web dashboard to ensure that the credit monitoring tool is functioning correctly. If you notice any discrepancies in the data or don’t receive expected alerts, reach out to customer service for assistance. Having a smooth setup is vital for effective monitoring.

Interpreting your credit usage data

Interpreting your credit usage data is key to understanding your financial health. When you analyze this data, you can identify patterns and trends in your credit behavior. This can guide you to make better financial decisions.

Understanding Credit Utilization Ratio

One of the most vital metrics to look at is your credit utilization ratio. This ratio shows how much credit you are using compared to your total available credit. A lower ratio often indicates better credit health. Aim to keep your utilization below 30%. If it exceeds this threshold, consider adjusting your spending habits.

Monitoring Changes Over Time

Tracking changes in your credit score is also crucial. Look specifically for increases or decreases in your score over time. If your score is rising, you are likely managing your credit well. On the other hand, if it drops, you should investigate the cause. Examine your recent spending habits, missed payments, or new accounts that may be affecting your score.

- Regular Reviews: Make it a habit to review your credit reports frequently.

- Focus on Significant Changes: Pay attention to changes that are more than a few points.

- Compare Data: Look for patterns by comparing your credit report data from month to month.

Understanding specific factors that influence your credit score is also important. Payment history, new credit inquiries, and the length of your credit history all play roles. Regularly check how these factors contribute to your overall score. This will help you prioritize which areas to focus on for improvement.

As you interpret your credit usage data, consider the insights these patterns provide. They are not just numbers but reflections of your financial habits. Use this information to set realistic financial goals, such as paying down existing debt or refraining from opening new credit lines unnecessarily.

In summary, effectively interpreting your credit usage data will empower you to manage your finances better. It will help you build and maintain a strong credit profile over time.

In conclusion, managing your credit through effective monitoring is essential for financial health. Using a credit usage monitoring tool empowers you to track your spending, understand your credit score, and make informed decisions. By interpreting the data accurately, you can better manage your finances and work towards improving your credit profile over time. Remember, the key is to stay informed, proactive, and engaged with your financial journey. Understanding your credit usage is not just about numbers; it’s about building your future.

FAQ – Frequently Asked Questions about Credit Usage Monitoring Tools

What is a credit usage monitoring tool?

A credit usage monitoring tool helps track your credit score and spending patterns, providing insights into your financial health.

How does credit utilization impact my credit score?

Credit utilization measures the amount of credit you use compared to your total available credit. A lower ratio usually indicates better credit health.

What features should I look for in a credit monitoring tool?

Look for features like credit score tracking, spending alerts, identity theft protection, and user-friendly interfaces.

How often should I check my credit usage data?

It’s recommended to review your credit usage data regularly, at least once a month, to stay informed and make necessary adjustments.