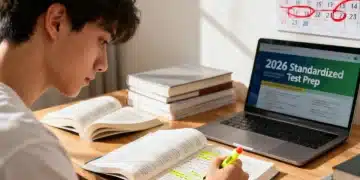

New Standardized Testing Requirements for US High Schools (Fall 2025)

Understanding the New Requirements for Standardized Testing in US High Schools Starting Fall 2025 involves significant shifts in content, format, and accessibility, aiming to provide a more accurate reflection of student knowledge and skills while addressing equity concerns. As the landscape of education evolves, so too do the methods used to assess student progress. Starting […]

Homeschool support grants: maximize your education budget

Homeschool support grants can enhance your child's education without breaking the bank. Discover the best options today!

Childcare subsidy 2025: what you need to know

Childcare subsidy 2025 is crucial for families seeking financial help. Discover the essentials and benefits in our guide.

State budget debates: understanding the issues at stake

State budget debates set the stage for crucial financial decisions. Discover what’s at stake in this essential discussion.

Get Free Cowboy-Style Gifts from Shein

Join Shein Country and get free cowboy-style gifts — boots, hats, and jackets shipped to your door.

Shein Country Style: Get the Western Look for Free

Discover Shein Country Style and get the western look for free with boots, denim, fringe, and cowboy-inspired fashion.