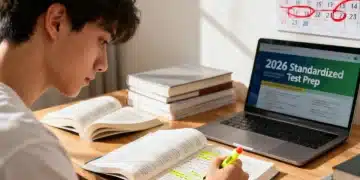

Online learning tools: unlock your potential today

Online learning tools can enhance your skills and knowledge, making education accessible and engaging.

New Energy-Efficient Home Improvement Tax Credit: Impact on Homeowners’ Finances

The new tax credit for energy-efficient home improvements, effective January 2025, will allow homeowners to claim a credit for qualified expenses, directly reducing their tax liability and making energy-saving upgrades more affordable. The new tax credit for how will the new tax credit for energy-efficient home improvements, effective January 2025, affect homeowners’ tax liabilities? is […]

Energy-Efficient Home Credit 2025: How It Affects Your Taxes

The new tax credit for energy-efficient home improvements, effective January 2025, will allow US homeowners to claim credits for qualified expenses that reduce their tax liabilities by improving their homes’ energy efficiency. Wondering how will the new tax credit for energy-efficient home improvements, effective January 2025, affect homeowners’ tax liabilities? This credit aims to make […]

Energy assistance programs that can transform your life

Energy assistance programs can lower your bills and improve your comfort. Discover the options available to you.

Presidential campaign coverage: navigate the complexities

Presidential campaign coverage can shape public perception. Discover insights that enhance your understanding of the election process.

401k rollover tips: maximize your retirement savings

401k rollover tips ensure you keep control over your savings and maximize growth potential. Discover essential steps to take today!