Living wage supplement guide: Understanding the benefits

Living wage supplement guide offers insights into how this financial aid can enhance your quality of life.

Community policy participation drive: a new approach

Community policy participation drive enlivens local engagement, inviting your voice to shape the policies that matter most.

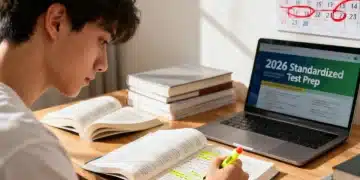

2025 Education Standards: How They’ll Change Your Child’s Learning

The updated 2025 US education standards aim to enhance critical thinking and prepare students for future challenges by integrating technology, emphasizing personalized learning, and focusing on real-world applications across all subjects. Are you wondering how will the updated 2025 US education standards affect your child’s curriculum? Understanding these changes is crucial for parents and educators […]

Daily budgeting assistant: take control of your finances

Daily budgeting assistant helps you manage your expenses efficiently and improve your financial health in no time.

Emotional learning strategies: unlock your potential

Emotional learning strategies help enhance personal growth and social skills, enabling a deeper connection with ourselves and others.

School meal benefit tracker: your guide to savings

School meal benefit tracker helps families save on meals while ensuring children receive nutrition. Discover how it works and what to do!