Improve Your Credit Score: How the FCRA Can Help You Gain 50 Points

Understanding the latest changes to the Fair Credit Reporting Act (FCRA) can empower consumers to correct inaccuracies, manage their credit reports effectively, and potentially boost their credit scores by an average of 50 points, enhancing their financial opportunities. Want to understand how can understanding the latest changes to the Fair Credit Reporting Act help consumers […]

Disaster relief assistance: how to make a difference now

Disaster relief assistance is crucial in urgent situations. Learn how you can contribute to impactful aid efforts today.

Win FREE Shein Western Outfits

Western fashion is making a comeback, and Shein brings it to life with trendy, budget-friendly pieces.

Ride the Trend: How to Own the Western Vibe with SHEIN 🤠

It guides you through bold prints, layered accessories and versatile ways to mix and match for daily wear.

Financial planning apps: take control of your finances

Financial planning apps can help you manage your money effectively. Discover their benefits and how to choose the best one for you.

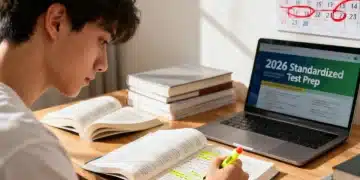

Understanding the New Standardized Testing Requirements for US High Schools in 2025

Understanding the New Requirements for Standardized Testing in US High Schools Starting Fall 2025 involves significant shifts in test formats, content, and administration, impacting how students prepare and how schools evaluate performance and readiness for higher education. Navigating the educational landscape is ever-evolving, and a key change on the horizon involves Understanding the New Requirements […]